Hey reader! 📰

If you’re new here, welcome and if not, welcome back! If you haven’t joined the 881 subscribed members yet and want an earnings summary each Saturday during each earnings season, you can sign up below for FREE (thank you to my paid subscribers!). And consider subscribing to the YouTube channel.

I haven’t sent out a newsletter since 2023, and I would like to apologize for that. You can expect 1-2 earnings summaries per week, depending on how many popular companies report (check your spam).

A friendly reminder that the stock price reaction after earnings might have nothing to do with how well/bad the company performed during the quarter.

Get 15% OFF Finchat HERE — New Users Will Get 2 Weeks of Finchat Pro for Free

Tesla (TSLA): Q1 2025 revenue $19.34B, down 9% YoY, missing $21.4B estimate. Adjusted EPS $0.27, below $0.42 forecast. Energy storage deployments hit 10.4 GWh, up 156.6% YoY, with energy revenue at $2.73B, up 67%. Auto margins fell due to lower deliveries (336,681, down 13% YoY) and discounts. CEO Elon Musk emphasized Robotaxi progress, targeting Austin launch in June 2025, and projected a million of Optimus robots by 2030.

Full review on the channel

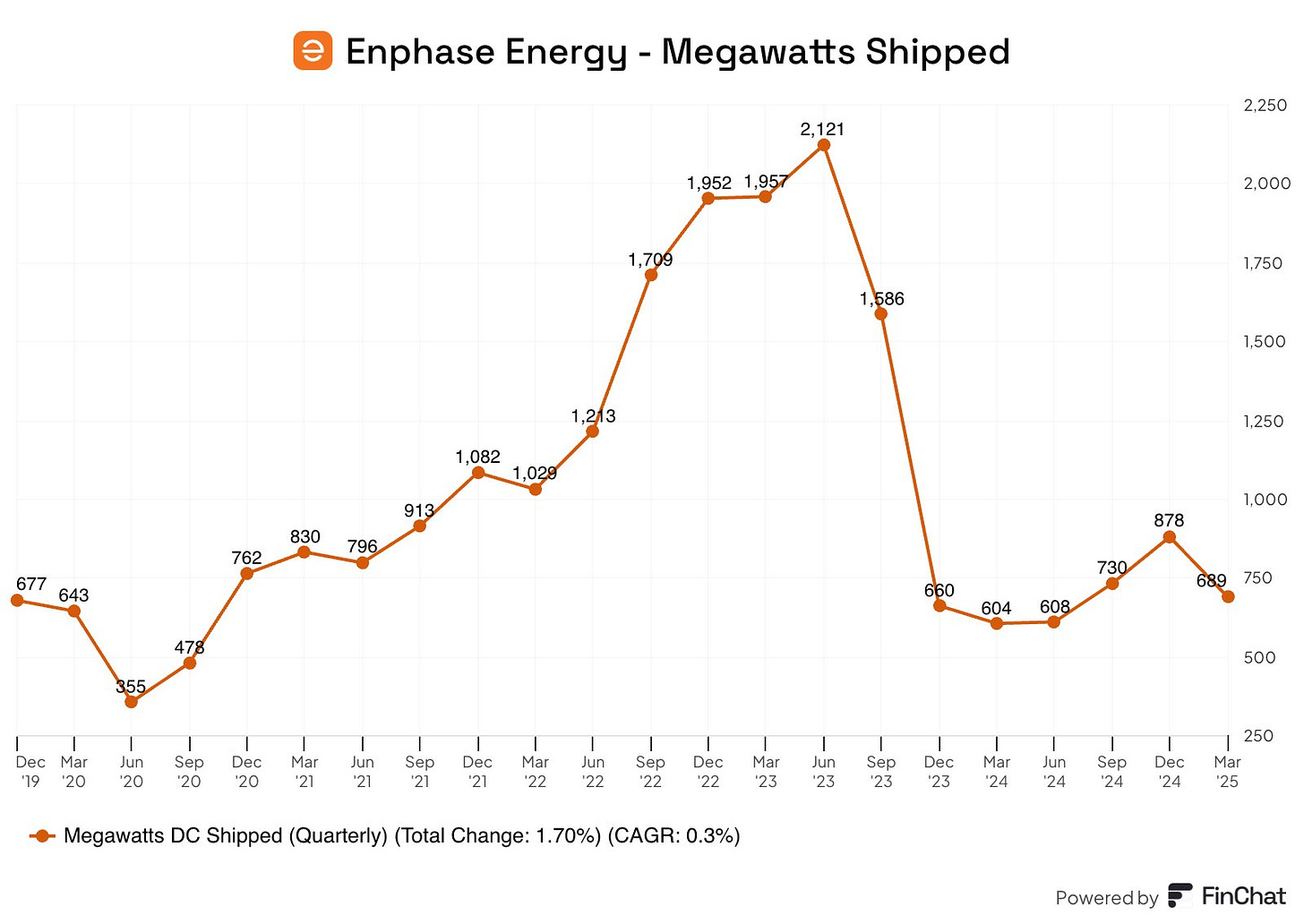

Enphase Energy (ENPH): Q1 revenue $356.1M, up 35% YoY but below $361M expected. Adjusted EPS $0.68, missing $0.70 estimate. Shipped 1.53M microinverters and 170.1 MWh of IQ Batteries. Management noted softer demand, with Q2 revenue guidance of $360M-$400M signaling caution.

Vertiv (VRT): Q1 2025 revenue $2.07B, up 25% YoY, beating $1.98B estimate. Adjusted EPS $0.71, surpassing $0.62 forecast. Strong AI-driven data center demand fueled growth, with orders up 60% YoY and backlog at $7.4B. CEO Giordano Albertazzi raised full-year 2025 guidance: revenue $9.33B-$9.58B (vs. $9.2B prior), EPS $3.45-$3.65 (vs. $3.15-$3.35). Management emphasized leadership in AI infrastructure, targeting $1B in AI-related bookings by 2026.

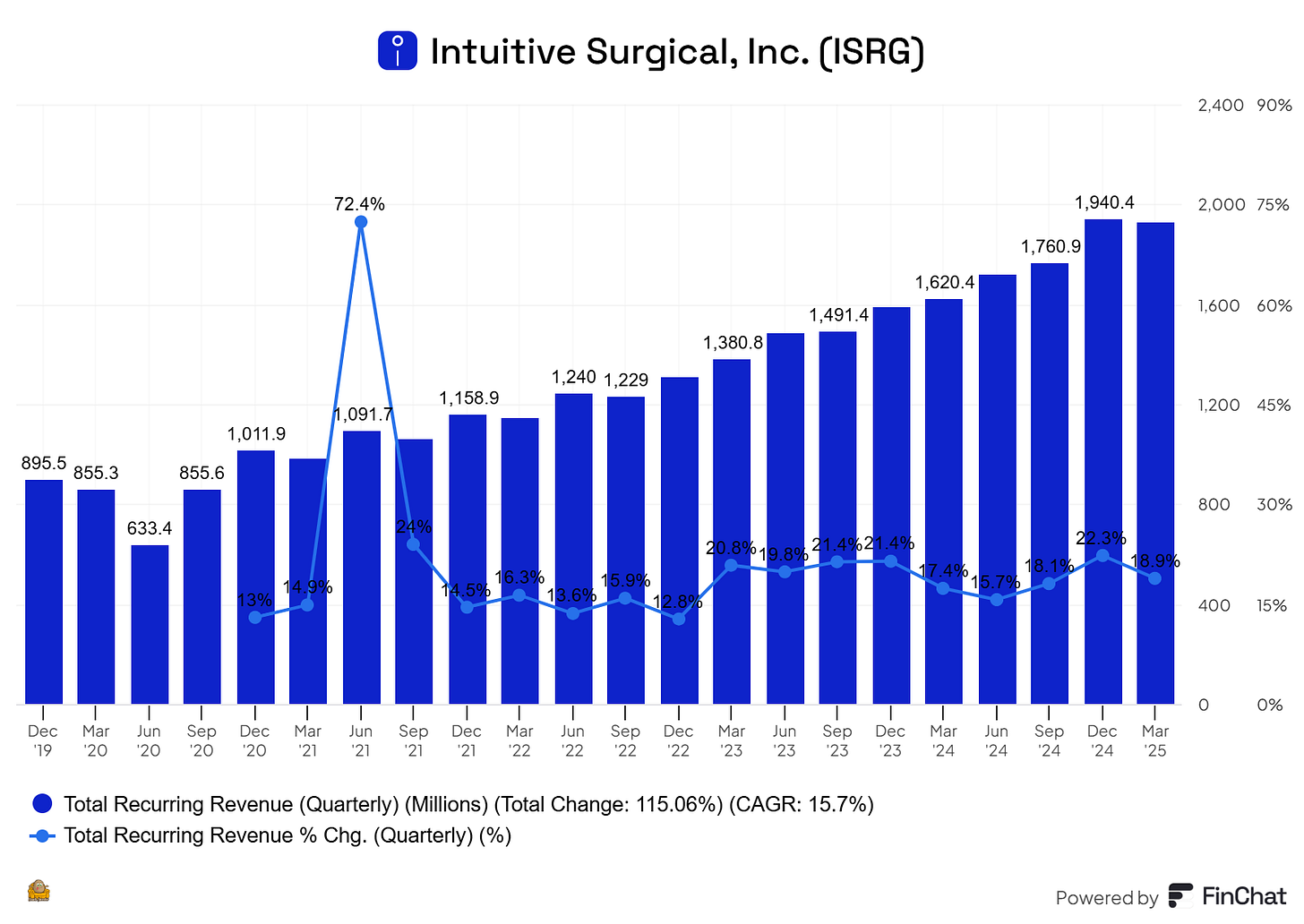

Intuitive Surgical (ISRG): Q1 adjusted EPS $1.81, beating $1.72 estimate; revenue $2.25B, above $2.19B forecast. Procedure growth up 17% YoY. Management raised FY25 procedure growth forecast but lowered margin guidance to 65-66.5% from 69.1% due to tariff impacts. Analysts noted solid fundamentals but flagged tariff-related margin pressure as a concern.

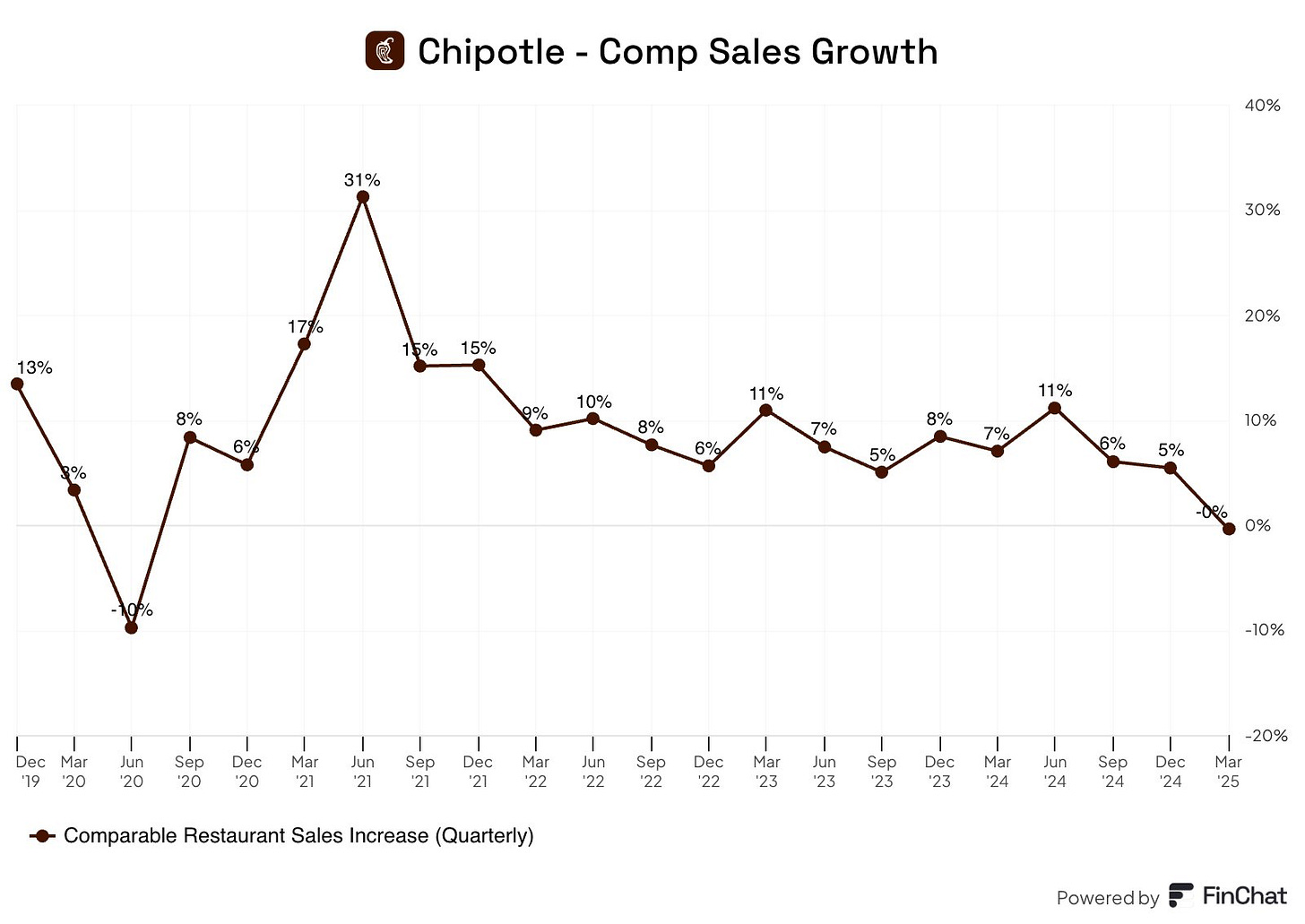

Chipotle Mexican Grill (CMG): Q1 2025 revenue $2.88B, up 6.7% YoY, missing $2.92B estimate. Adjusted EPS $0.29, beating $0.28 forecast. Same-store sales fell 0.5% YoY, first decline since 2020, due to softer demand and weather. CEO Scott Boatwright cited delayed "burrito season" and consumer spending slowdown, projecting low single-digit same-store sales growth for 2025. CFO Adam Rymer noted tariff-driven cost inflation (0.2% Q2 impact).

Lam Research (LRCX): Q1 2025 (ended Mar. 2025) revenue $4.8B, up 26% YoY, beating $4.59B estimate. Adjusted EPS $1.04, surpassing $1.00 forecast. Strong demand for memory and AI chips drove growth. Management raised Q4 guidance to $4.7B-$5.3B revenue, $1.10-$1.30 EPS, above consensus ($4.45B, $0.98). CEO Tim Archer highlighted resilient equipment spending. Analysts upbeat on AI-driven outlook.

IBM (IBM): Q1 2025 revenue $14.5B, up 1.5% YoY, topping $14.4B estimate. Adjusted EPS $1.60, beating $1.42 forecast. Software segment grew 5.5%, driven by AI and hybrid cloud. CEO Arvind Krishna emphasized generative AI momentum, with $3B in AI bookings. Q2 revenue guidance $16.4B-$16.75B, above $16.3B estimate. Analysts mixed, citing mainframe cycle concerns.

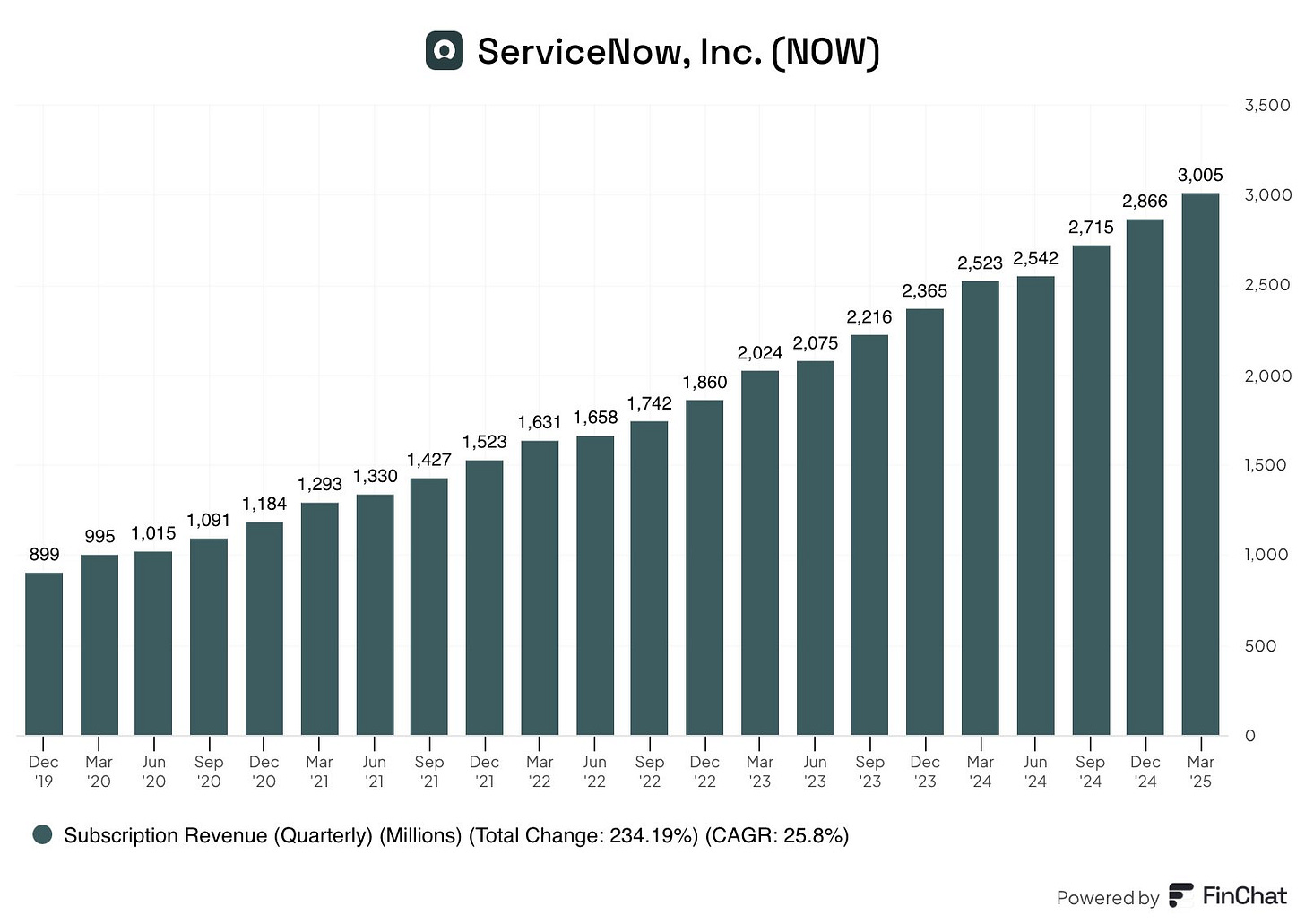

ServiceNow (NOW): Q1 2025 revenue $3.09B, up 22% YoY, edging $3.08B estimate. Adjusted EPS $4.04, beating $3.83 forecast. Subscription revenue grew 24%, fueled by AI workflow demand. CEO Bill McDermott raised full-year subscription revenue guidance to $12.73B-$12.78B, signaling confidence in AI adoption. Analysts bullish, citing strong enterprise software demand.

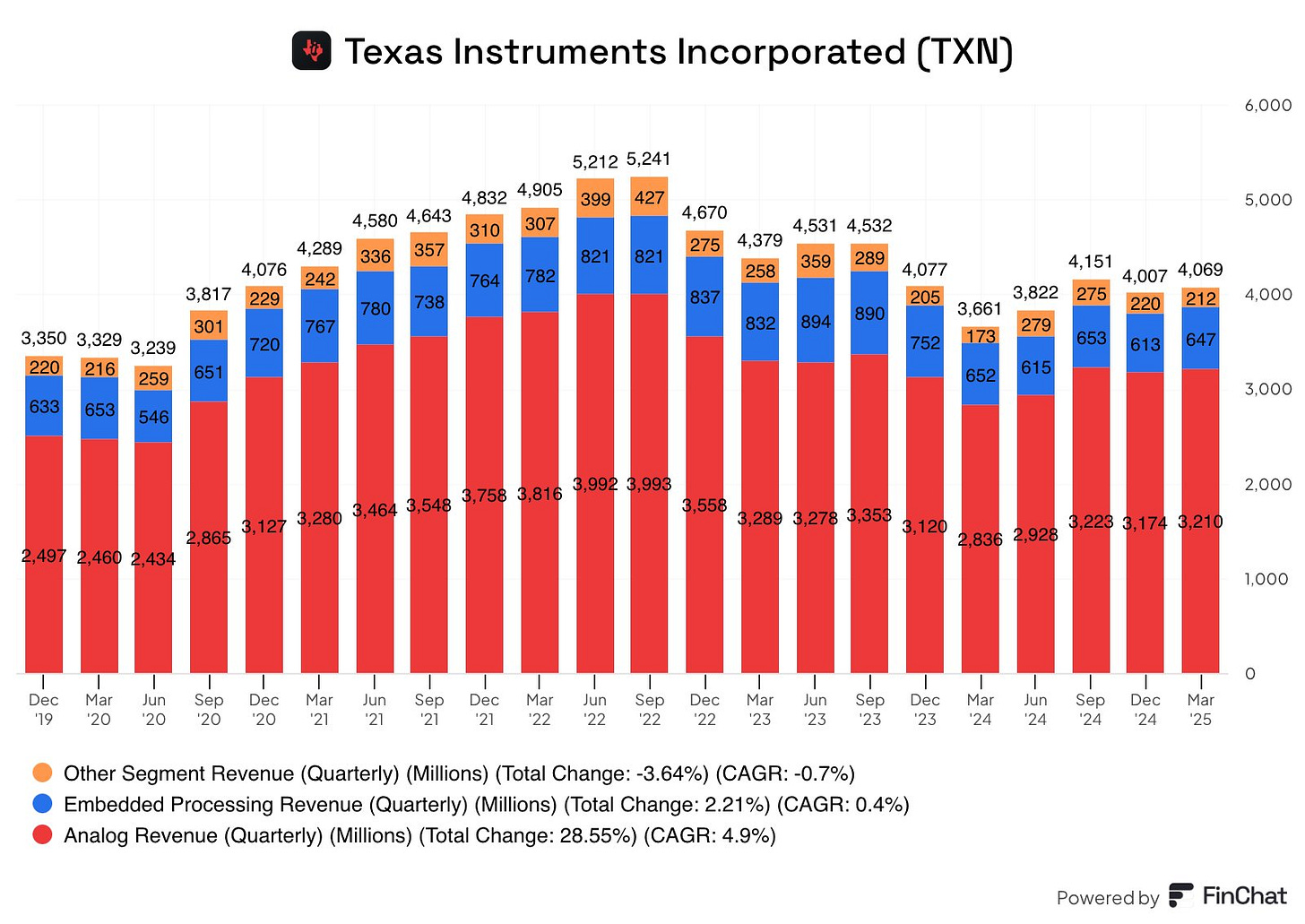

Texas Instruments (TXN): Q1 2025 revenue $4.07B, down 5% YoY, beating $3.91B estimate. Adjusted EPS $1.28, topping $1.06 forecast. Analog and embedded chip demand offset automotive weakness. CEO Haviv Ilan raised Q2 guidance to $3.95B-$4.25B revenue, above $3.9B estimate. Analysts see recovery signs despite soft auto market.

Intel and Alphabet’s earnings review will be posted on the channel.