Hey reader! 📰

If you’re new here, welcome, and if not, welcome back! If you haven’t joined the 881 subscribed members yet and want an earnings summary each Saturday during each earnings season, you can sign up below for FREE (thank you to my paid subscribers!). And consider subscribing to the YouTube channel.

In case you missed part 1, HERE IT IS.

A friendly reminder that the stock price reaction after earnings might have nothing to do with how well/bad the company performed during the quarter.

Get 15% OFF Finchat HERE — New Users Will Get 2 Weeks of Finchat Pro for Free

Intel (INTC): Q1 2025 revenue $12.67B, flat YoY, beating $12.3B estimate. Adjusted EPS $0.13, above $0.01 forecast. Client Computing revenue $7.8B (vs. $6.9B expected), Data Center and AI $4.1B (vs. $2.9B), Foundry $4.6B (vs. $4.3B). CEO Lip-Bu Tan announced cost cuts, targeting $17B operating expenses in 2025, $16B in 2026, and $18B capex in 2025. Q2 guidance weak: $11.2B-$12.4B revenue (vs. $12.8B estimate), $0.00 EPS (vs. $0.06). Tan emphasized efficiency and AI strategy, but analysts noted tariff risks and AI market lag.

Alphabet (GOOGL): Q1 2025 revenue $89.2B, up 11% YoY, matching $89.2B estimate. Adjusted EPS $2.02, in line with $2.02 forecast. Google Cloud revenue $12B, up 25% YoY, slightly below $12.3B expected. CEO Sundar Pichai highlighted Gemini AI integration across Search, YouTube, and Cloud, driving ad and subscription growth. Management raised full-year cloud revenue outlook, citing AI demand. Analysts remain bullish, with Citi and Morgan Stanley citing AI-driven Search and YouTube growth, though TD Cowen cut price target to $195 on ad growth concerns.

Boeing (BA): Q1 2025 revenue $19.5B, up 18% YoY, beating $19.2B estimate. Net loss narrowed to $31M from $355M YoY; adjusted EPS -$0.05, above -$1.24 forecast. Commercial airplane revenue $8.1B, up 75%, with 130 deliveries (vs. 83 YoY). Cash burn $2.3B, better than $4B expected. CEO Kelly Ortberg highlighted production stabilization and a $10.55B Jeppesen sale to Thoma Bravo, but noted tariff impacts.

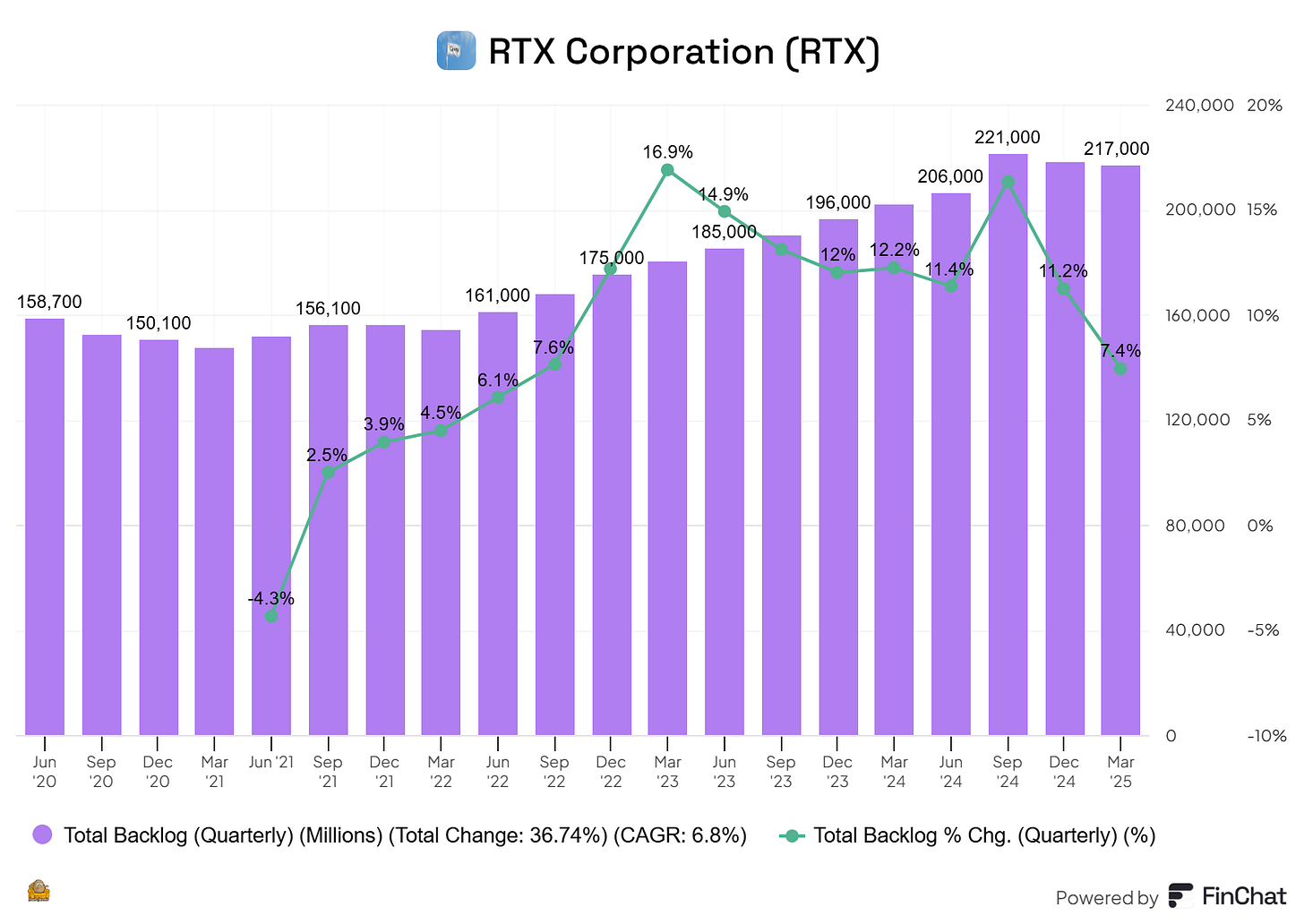

RTX (RTX): Q1 2025 revenue $20.1B, up 12% YoY, topping $19.7B estimate. Adjusted EPS $1.34, beating $1.29 forecast. Pratt & Whitney sales up 23% to $6.5B; Collins Aerospace up 14% to $7.1B. CEO Chris Calio raised full-year EPS guidance to $5.65-$5.85 (vs. $5.50-$5.70). Management noted $1B+ tariff costs in 2025.

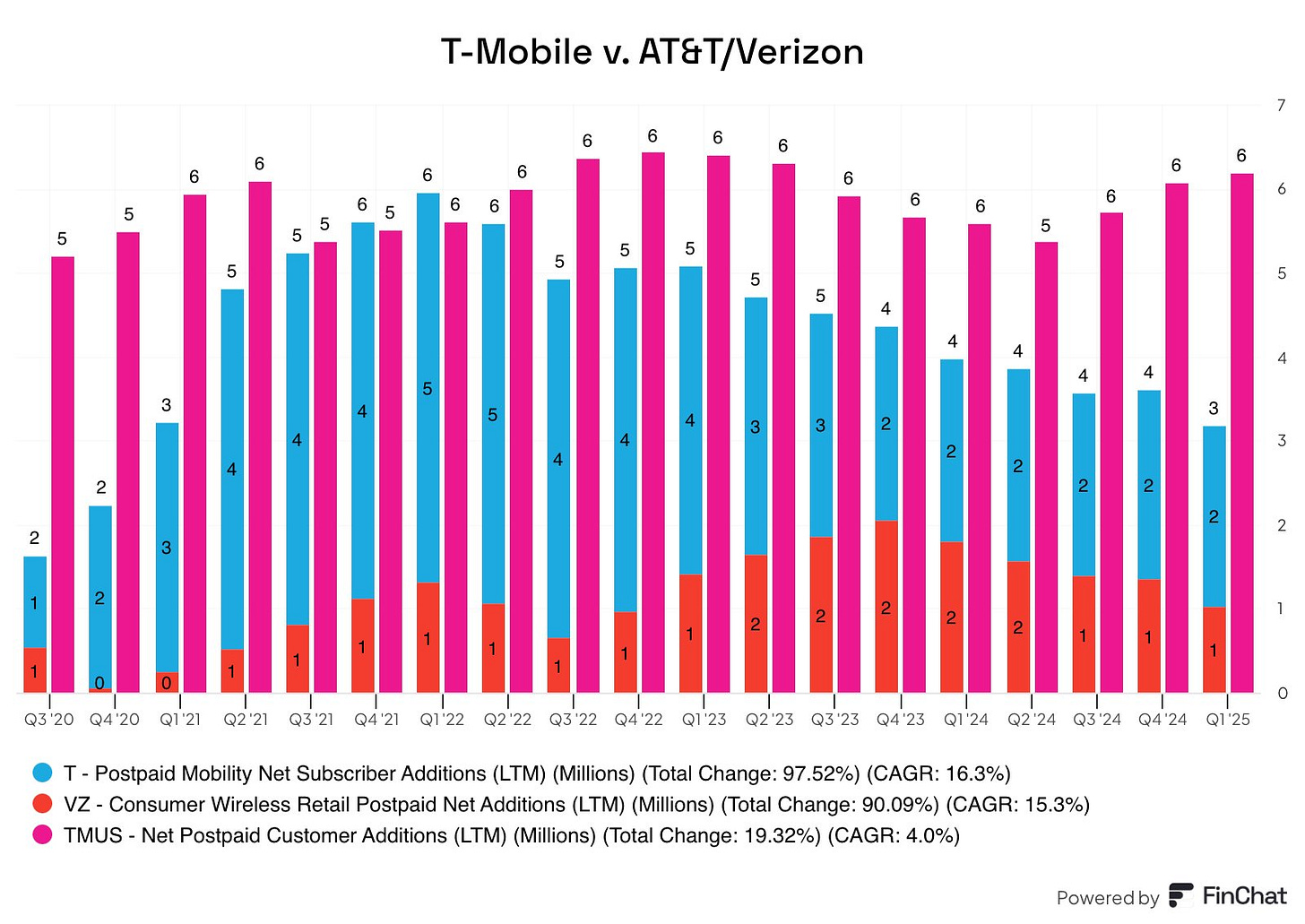

Verizon (VZ): Q1 2025 revenue $33.3B, flat YoY, matching $33.3B estimate. Adjusted EPS $1.15, in line with $1.15 forecast. Lost 289,000 postpaid phone subscribers (vs. 568,000 gain prior quarter). Broadband added 339,000 customers, driven by fixed wireless and fiber. CEO Hans Vestberg reaffirmed 2%-2.8% wireless revenue growth for 2025, excluding tariff impacts.

T-Mobile (TMUS): Q1 2025 revenue $20.7B, up 4% YoY, beating $20.4B estimate. Adjusted EPS $2.25, above $2.15 forecast. Added 405,000 postpaid phone customers and 218,000 broadband customers. Service revenue grew 5% to $16.8B; high-speed internet hit 5.5M customers. CEO Mike Sievert raised 2025 guidance, projecting 3%-4% service revenue growth.

SAP (SAP): Q1 2025 revenue €8.3B ($8.83B), up 8% YoY, slightly above $8.8B estimate. Adjusted EPS €1.25 ($1.33), beating $1.30 forecast. Cloud revenue grew 24% to €4.2B, driven by AI and Business Technology Platform. CEO Christian Klein raised full-year cloud revenue outlook to €17.5B-€18B, citing AI adoption.